Alibaba surges in huge IPO debut

Alibaba surges in huge IPO debut

Alibaba, the biggest IPO to ever hit Wall Street, made a huge splash in its debut on Friday.

Shares of the Chinese e-commerce giant opened at $92.70. That marks a 36% pop from the $68 price of its record-shattering initial public offering.

The first day of trading can be very volatile for any stock. Alibaba continued to climb and nearly hit $100 before sinking back below the opening price for awhile.

The early bounce signals optimism among investors about Alibaba's (BABA) ability to continue its rapid growth trajectory as China's middle class grows and and the company expands to other parts of the world.

Moments after the stock started trading the founder and CEO of the company, Jack Ma, told CNNMoney he's "honored" and "humbled."

Ma told CNBC that years from now he wants Alibaba to be compared with American icons like Wal-Mart (WMT), Microsoft (MSFT, Tech30) and IBM (IBM, Tech30). People will say Alibaba "changed the world," he said.

Unlike the disastrous 2012 Facebook (FB, Tech30)IPO on Nasdaq, Alibaba's first few minutes as a public company went smoothly. That's good news for the New York Stock Exchange, where Alibaba chose to list its high-profile IPO under the ticker symbol "BABA."

Alibaba raised $21.8 billion late Thursday by pricing its IPO at $68 per share. That's the largest ever IPO for a company listed on an American exchange.

Goldman Sach (GS)and the other investment banks that made the IPO happen have the option to purchase additional shares. If those options are exercised as expected, the Alibaba deal would raise $25 billion -- a world record.

Alibaba is cashing in on a very bullish overall atmosphere for stocks. The S&P 500 touched a new all-time high on Friday.

alibaba ipo nyse opening bell

Don't worry. If you've never heard of Alibaba, you haven't been living under a rock.

The Chinese company, which was founded in 1999 by former English teacher Ma, has yet to make its presence felt in the U.S. But the truckload of new cash raised by the mega IPO should change that.

Alibaba has largely focused on the exploding Chinese Internet market, which has already made the company a dominant player in e-commerce.

Roughly $248 billion of merchandise exchanged hands on Alibaba's platforms in 2013, according to IDC. That trumps the gross merchandise volume of Amazon.com (AMZN, Tech30), eBay (EBAY, Tech30), JD.com (JD) and Japan's Rakuten (RKUNF) -- combined.

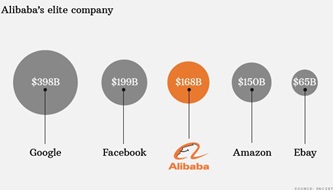

Thanks to those impressive figures, Alibaba starts life with some elite company you've definitely heard of. At the $68 IPO price, Alibaba was valued at $168 billion. That's more than 20-year-old Amazon.com .

But the early pop gives it an even more impressive valuation of $228.5 billion, which is about $30 billion more than Facebook. It's also less than halfway to Google (GOOGL, Tech30) status.

The Alibaba IPO price also put a lofty valuation on the company. Based on its earnings for the year ended March 31, the deal values Alibaba at a lofty price-to-earnings multiple of 44. That metric will climb to even more expensive levels as Alibaba climbs above $68.

Analysts at Cantor Fitzgerald launched coverage of Alibaba on Friday with a "buy" rating, although the stock is already approaching the firm's $90 price target.

"We believe that a differentiated pricing model, strong brand and unmatched scale give Alibaba an unfair competitive advantage," Cantor analyst Youssef Squali wrote in a note.

Retail investors are showing some serious interest in Alibaba. TD Ameritrade (AMTD) said Alibaba orders are on track to represent 15% of daily average revenue trades at the brokerage. By comparison, Facebook represented 22% of trades on its IPO day and Twitter (TWTR, Tech30) was about 5%.

Yahoo (YHOO, Tech30) investors are also cheering because the U.S. Internet company is cashing in a chunk of its investment in Alibaba. After taxes, Yahoo is poised to make around $5.1 billion by selling about 122 million Alibaba shares. Yahoo is holding onto a major stake that translates to billions more in value.

Boom: Alibaba surges in huge IPO debut

By Matt Egan @mattmegan5 September 19, 2014: 3:27 PM ET

NEW YORK (CNNMoney)

alibaba market value 3

中国 アリババ 過去最大額の上場へ9月19日 10時28分

中国最大のネット通販サイトなどを運営するアリババグループは、ニューヨーク証券取引所への上場を翌日に控えた18日、株式の公開価格を発表し、上場によって調達する資金は、最大で日本円でおよそ2兆7000億円と過去最大になります。

アリババグループは18日、新規に公開する株式の価格を1株当たり68ドルにすると発表しました。

これはアリババがこれまで公表していた公開価格の目安の上限に当たります。

この結果、アリババが調達する資金は最大で250億ドル、日本円でおよそ2兆7000億円となり、2010年に上場した中国農業銀行の221億ドルを上回り過去最大となります。

アリババは、190を超える国と地域でネット通販や企業間の取引サイトなどを運営する中国の会社で、新たに調達する資金をてこに、アメリカなどでの事業を強化するものとみられています。

アリババは、19日にニューヨーク証券取引所に株式を上場する予定で、市場が企業価値をどのように評価するのか注目が集まっています。

|